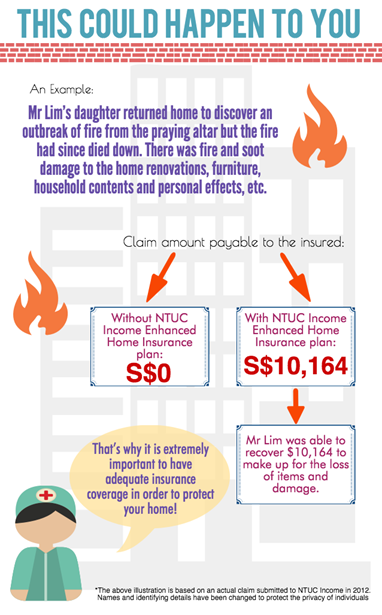

This Infograph Will Show You Why Your Basic Fire Insurance Scheme Is Not Enough

Maintenance & Repair4 minutes read

10416 views

10416 views

Imagine returning home to discover a fire broke out in your kitchen while you were at work. What used to be the most perfect kitchen layout has turned into unrecognisable piles of ash and dust.

Who will compensate the built-in carpentry that the contractor painstakingly crafted?

“But I’ve got the basic fire insurance plan!”

In our highly educated society, this is unfortunately an area where many Singaporeans lack sufficient knowledge in. If a property is mortgaged, HDB or the financial institution will require the homeowners to take up fire insurance. However, the cover for such insurance is very basic as the insured value is limited to either the outstanding loan amount or the cost of reinstating the building structure.

Such basic fire insurance schemes only graze the bare minimum of reimbursements.

To save you and your family from the anguish of future mishaps, protect the contents of your home by being well-insured.

But What Does It MeanTo Be Well-Insured?

The following is an actual incident that happened to *Mr. Lim and his family three years back.

By author.

Live With Peace Of Mind With NTUC Income’s Enhanced Home Insurance

With NTUC Income’s Enhanced Home Insurance plan, your home will have the comprehensive protection it needs. The plan not only covers basic structural damage, but also loss or damage to household items, renovation works and valuables (e.g. antiques, works and art, and jewellery) due to incidents such as burst water pipes/tanks and home fires.

Be it a HDB flat, condominium, or landed home, there’s a Home insurance plan for everyone.

If you have an existing plan that covers the building structure of your residence, or if you’re living in a rented place, NTUC Income’s standard Home Insurance plan would be suitable for you.

For a more extensive coverage, opt for the comprehensive plan that also covers the building structure of your abode.

|

HDB Flat Owners:

|

Private Home Owners:

|

|

Choose from Standard, Comprehensive, or Flexible plans here.

|

Choose from Standard, Comprehensive, or Flexible plans here

|

Exclusive Promotion For RenoTalkers!

Because we’ve seen so many stunning renovation projects, we fully understand the heartache one would feel should a tragedy occur. We want your home to be well-insured as much as you do, which is why we’re happy to share this promotion from NTUC Income!

Enjoy 15% off premiums when you sign up for NTUC Income’s Enhanced Home Insurance 3-year plan today! The 1st 750 new sign-ups will also receive a Shake n Take 3 Blender worth $69! Offer is valid till Dec 31, 2015. Call 6788-1111 and quote “RENOTALK15” to enjoy this promotion. For terms and conditions of the promotion, visit www.income.com.sg/Renotalk15.

For more information on NTUC Income’s Enhanced Home Insurance plan, visit www.income.com.sg/Home-Insurance.

Request for quotes and we'll match you with a selection of Interior Designers!

Previous

Gorgeous Work Space Interiors

Sign Up with Google

Sign Up with Google

.jpg)